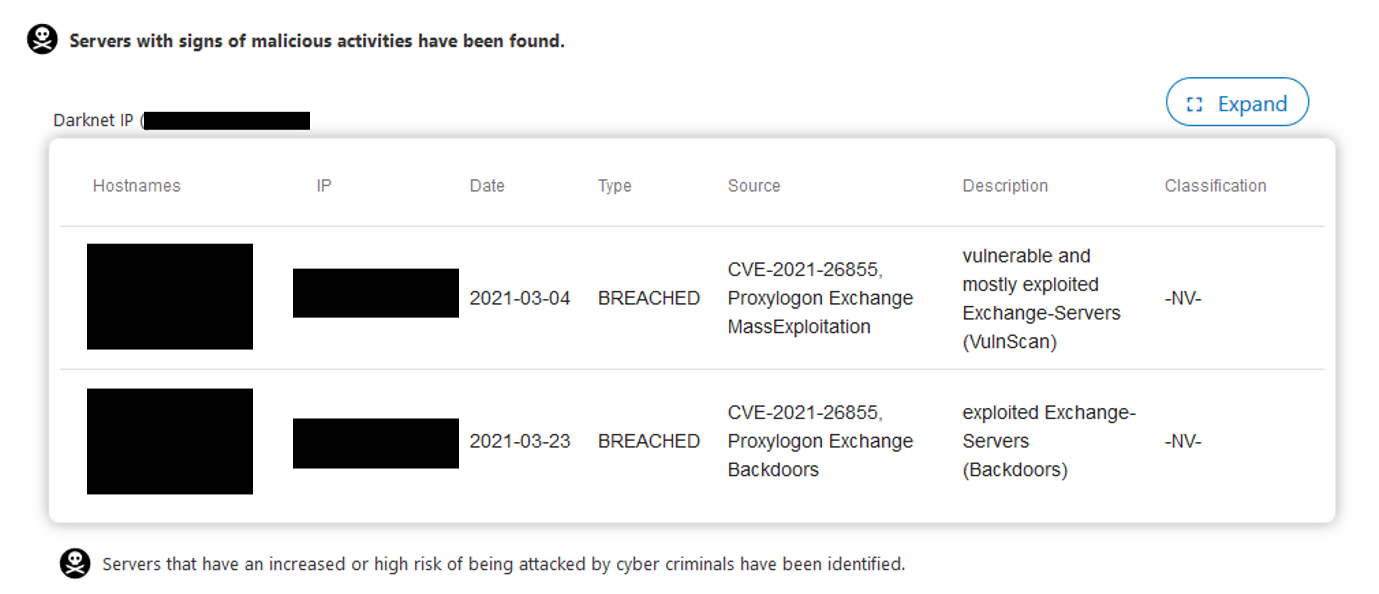

When the Proxylogon/MS Exchange vulnerability caused a big stir in the insurance industry in early March, the insurance company was able to actively communicate with likely affected customers thanks to a targeted analysis of these vulnerabilities and thus contribute to damage prevention.

Fast and targeted analyses of larger portfolio structures can be carried out efficiently with cysmo Analytics. Complex correlations in the geographical distribution of server structures can be analysed, but also concrete vulnerabilities related to known and new flaws.

Vendor

Contacts

Jonas Schwade

PPI AG

Produktmanager

Germany

Responsible for this content

PPI AG

Germany

- Germany

- Spain

- Switzerland

- Austria

- United States

- United Kingdom

Views: 22372

Downloads: 0

Page is favored by 1 user.

Contact inquiries: 0

Disclaimer

External vendor partners can provide content on hr | equarium. Hannover Rück SE does not verify these contents. Hannover Rück SE is also not responsible and not liable for the contents and services offered. For more information please see the terms of use.